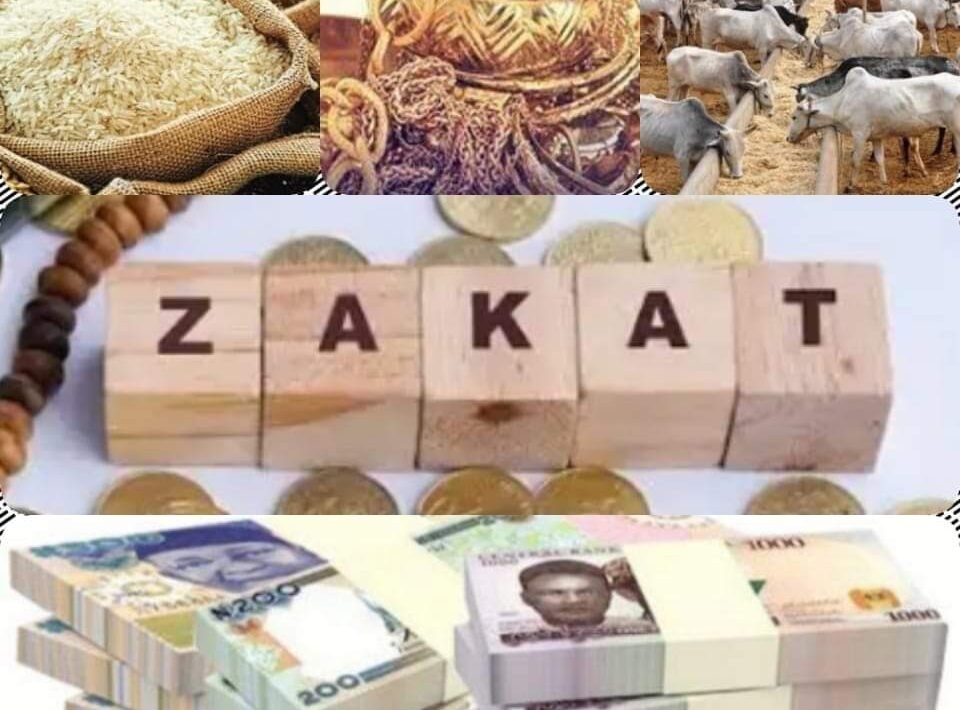

Nisabin zakka ta kudi is an Arabic term that refers to the minimum amount of wealth that a Muslim must possess before they are obligated to pay the religious tax known as zakah. The nisab is set at the value of 85 grams of gold or its equivalent in other forms of wealth.

Zakah is one of the five pillars of Islam, and it is considered to be a form of worship. Muslims are obligated to pay zakah on their savings, investments, and business profits. The nisab ensures that only those who are able to afford it are obligated to pay zakah.

The nisab has been set at a relatively low level so that as many Muslims as possible are able to fulfill their obligation to pay zakah. This ensures that the benefits of zakah are distributed widely throughout the Muslim community.

Nisabin zakka ta kudi

The nisabin zakka ta kudi is a crucial aspect of the Islamic religious tax known as zakah. Here are 10 key aspects related to the nisabin zakka ta kudi:

- Definition: Minimum amount of wealth required to pay zakah

- Value: 85 grams of gold or its equivalent

- Purpose: Ensures that only those who can afford it pay zakah

- Obligation: Muslims must pay zakah on savings, investments, and business profits

- Distribution: Benefits of zakah are distributed widely throughout the Muslim community

- Historical significance: Mentioned in the Quran and Sunnah

- Economic impact: Contributes to the financial well-being of the Muslim community

- Spiritual significance: Considered a form of worship and purification

- Social justice: Helps to reduce wealth inequality

- Global reach: Applicable to Muslims worldwide

In conclusion, the nisabin zakka ta kudi is a multifaceted concept that plays a vital role in the Islamic financial system. It ensures that zakah is paid by those who can afford it, and that the benefits of zakah are distributed equitably throughout the Muslim community. The nisabin zakka ta kudi is also a reminder of the importance of wealth sharing and social justice in Islam.

Definition

In the context of "nisabin zakka ta kudi," the definition of the minimum amount of wealth required to pay zakah is of paramount importance. This threshold, known as the nisab, serves as a benchmark that determines whether an individual is obligated to fulfill the religious duty of paying zakah. Understanding the significance of this definition and its implications is crucial for Muslims seeking to adhere to the tenets of their faith.

- Facet 1: Establishing Financial Responsibility

The nisab acts as a financial threshold that distinguishes between those who are considered financially capable of contributing to zakah and those who are not. By setting a minimum level of wealth, it ensures that zakah is primarily borne by individuals who have the means to do so, fostering a sense of responsibility and fairness within the Muslim community.

- Facet 2: Ensuring Equitable Distribution

The nisab plays a vital role in ensuring the equitable distribution of wealth within the Muslim community. By requiring zakah payments only from those who meet the nisab, it prevents the undue burdening of less affluent individuals. This equitable approach promotes social justice and ensures that zakah benefits reach those who are most in need.

- Facet 3: Encouraging Financial Growth

The nisab serves as an incentive for Muslims to strive for financial growth and prosperity. Knowing that they will only be obligated to pay zakah once they reach a certain level of wealth can motivate individuals to work hard, invest wisely, and manage their finances responsibly.

- Facet 4: Promoting Spiritual Purification

Beyond its financial implications, the nisab also carries spiritual significance. Zakah is considered an act of worship and purification, and paying it willingly and promptly is believed to cleanse one's wealth and bring blessings. The nisab, by setting a threshold for zakah obligation, helps individuals assess their spiritual readiness and commitment to this important religious duty.

In conclusion, the definition of the minimum amount of wealth required to pay zakah, known as the nisab zakka ta kudi, is a multifaceted concept that encompasses financial responsibility, equitable distribution, encouragement of financial growth, and spiritual purification. Understanding this definition is essential for Muslims seeking to fulfill their religious obligations and contribute to the well-being of their community.

Value

The value of the nisabin zakka ta kudi, set at 85 grams of gold or its equivalent, holds significant religious and practical implications. This specific value serves as a benchmark against which an individual's wealth is measured to determine their obligation to pay zakah.

- Facet 1: Historical Significance

The value of 85 grams of gold has its roots in Islamic history and tradition. It is believed to have been established during the time of the Prophet Muhammad (PBUH) and has remained unchanged since then. This historical connection lends credibility and authenticity to the nisab.

- Facet 2: Universal Applicability

The use of gold as the reference point for the nisab ensures its universal applicability across different cultures and economies. Gold is a precious metal that has been recognized and valued throughout history, making it a suitable and consistent measure of wealth.

- Facet 3: Practical Considerations

Setting the nisab at a specific value, rather than leaving it open to interpretation, provides clarity and ease of implementation. It eliminates ambiguity and ensures that individuals can readily determine their zakah obligations.

- Facet 4: Encouraging Economic Growth

By pegging the nisab to the value of gold, it is indirectly linked to economic growth and inflation. As the economy grows and inflation rises, the value of gold tends to increase as well. This dynamic adjustment helps ensure that the nisab remains relevant and prevents it from becoming too high or too low over time.

In conclusion, the value of the nisabin zakka ta kudi, set at 85 grams of gold or its equivalent, is not arbitrary but rather carries historical, practical, and economic significance. It provides a clear and universally applicable benchmark for determining zakah obligations, while also adapting to changing economic conditions.

Purpose

The purpose of the nisabin zakka ta kudi is to ensure that only those who can afford it pay zakah. This is a fundamental principle of zakah, which is a form of worship and a means of purifying one's wealth. By setting a minimum threshold of wealth, the nisab ensures that zakah is paid by those who have the means to do so, while exempting those who are struggling financially.

- Facet 1: Social Justice

The nisab promotes social justice by ensuring that the burden of zakah is shared fairly among the Muslim community. It prevents the undue burdening of the poor and needy, who are themselves in need of assistance. By exempting those below the nisab, zakah helps to redistribute wealth and reduce economic inequality.

- Facet 2: Encouraging Financial Responsibility

The nisab encourages Muslims to strive for financial success and self-sufficiency. Knowing that they will only be obligated to pay zakah once they reach a certain level of wealth can motivate individuals to work hard, invest wisely, and manage their finances responsibly. This contributes to the overall economic development of the Muslim community.

- Facet 3: Spiritual Purification

Zakah is not merely a financial obligation, but also a form of spiritual purification. By paying zakah, Muslims cleanse their wealth and fulfill a religious duty. The nisab ensures that zakah is paid by those who are spiritually ready and able to do so, fostering a sense of gratitude and accountability.

- Facet 4: Practical Implementation

The nisab provides a clear and practical benchmark for determining zakah obligations. By setting a specific threshold of wealth, it eliminates ambiguity and makes it easy for individuals to calculate how much zakah they owe. This simplifies the process of zakah collection and distribution, ensuring that funds are allocated efficiently.

In conclusion, the nisabin zakka ta kudi serves a crucial purpose in ensuring that only those who can afford it pay zakah. It promotes social justice, encourages financial responsibility, fosters spiritual purification, and provides a practical framework for zakah implementation. Understanding the purpose and implications of the nisab is essential for Muslims seeking to fulfill their religious obligations and contribute to the well-being of their community.

Obligation

The obligation to pay zakah on savings, investments, and business profits is closely tied to the concept of nisabin zakka ta kudi, which sets the minimum threshold of wealth that triggers the obligation to pay zakah. This connection underscores the importance of understanding both aspects to fulfill the religious duty of zakah.

- Facet 1: Determining Zakah Liability

The nisabin zakka ta kudi plays a crucial role in determining whether an individual is liable to pay zakah on their savings, investments, and business profits. If the total value of these assets exceeds the nisab, then zakah becomes obligatory. This threshold ensures that only those who have the means to do so are obligated to pay zakah.

- Facet 2: Calculating Zakah Amount

Once the obligation to pay zakah is established, the nisabin zakka ta kudi also helps in calculating the amount of zakah due. Zakah is calculated as a percentage of the total value of eligible assets that exceed the nisab. By setting a clear threshold, the nisab simplifies the calculation process and ensures that individuals pay the correct amount of zakah.

- Facet 3: Promoting Economic Justice

The nisabin zakka ta kudi contributes to economic justice by ensuring that zakah is paid by those who can afford it. Exempting individuals below the nisab from zakah obligations prevents the undue burdening of the poor and needy. This equitable distribution of zakah helps to reduce wealth inequality and fosters a sense of social responsibility within the Muslim community.

- Facet 4: Encouraging Financial Growth

The obligation to pay zakah on savings, investments, and business profits can motivate Muslims to strive for financial success and self-sufficiency. Knowing that they will be obligated to share a portion of their wealth once they reach the nisab can encourage individuals to work hard, invest wisely, and manage their finances responsibly. This contributes to the overall economic development of the Muslim community.

In conclusion, the obligation to pay zakah on savings, investments, and business profits is inextricably linked to the nisabin zakka ta kudi. The nisab serves as a threshold that determines zakah liability, helps calculate the amount of zakah due, promotes economic justice, and encourages financial growth. Understanding this connection is essential for Muslims seeking to fulfill their religious obligations and contribute to the well-being of their community.

Distribution

The nisabin zakka ta kudi is closely connected to the wide distribution of zakah benefits throughout the Muslim community. This connection stems from the fact that the nisab sets the minimum threshold of wealth at which zakah becomes obligatory. By exempting individuals below the nisab from zakah payments, the nisab ensures that zakah is primarily collected from those who have the means to contribute. This equitable distribution of zakah helps to reduce wealth inequality and foster a sense of social solidarity within the Muslim community.

The benefits of zakah are vielfltig and far-reaching. Zakah funds are used to support a wide range of social welfare programs, including providing food and shelter for the poor, assisting orphans and widows, and funding education and healthcare initiatives. By ensuring that zakah is distributed widely throughout the Muslim community, the nisabin zakka ta kudi plays a vital role in promoting social justice and improving the lives of the most vulnerable members of society.

In conclusion, the nisabin zakka ta kudi is not merely a financial threshold but also a mechanism for ensuring the equitable distribution of zakah benefits throughout the Muslim community. By exempting those below the nisab from zakah obligations, the nisab ensures that zakah is primarily paid by those who can afford it, thereby promoting social justice and fostering a sense of shared responsibility within the Muslim community.

Historical significance

The nisabin zakka ta kudi holds immense historical significance as it finds its roots in the sacred texts of Islam, namely the Quran and the Sunnah. This religious foundation serves as a cornerstone of the obligation to pay zakah, reinforcing its importance within the Muslim community.

In the Quran, Allah (SWT) commands Muslims to pay zakah in numerous verses. For instance, in Surah Al-Baqarah, verse 43, it is stated: "And establish prayer and give zakah." This verse clearly establishes zakah as one of the fundamental pillars of Islam, alongside prayer.

Furthermore, the Sunnah, which comprises the sayings and practices of Prophet Muhammad (PBUH), provides detailed guidance on the nisabin zakka ta kudi. In a hadith narrated by Abu Dawood, the Prophet (PBUH) said: "There is no zakah on wealth until it reaches the nisab." This hadith sets the nisab as a prerequisite for the obligation of zakah, exemplifying the importance of this historical context.

Understanding the historical significance of the nisabin zakka ta kudi is crucial for Muslims as it underscores the religious basis of this obligation. By recognizing its roots in the Quran and Sunnah, Muslims can appreciate the sanctity and importance of fulfilling this duty.

Economic impact

The nisabin zakka ta kudi plays a pivotal role in ensuring the financial well-being of the Muslim community. By setting a minimum threshold of wealth for zakah obligation, the nisab ensures that only those who can afford it are required to pay. This equitable distribution of zakah promotes social justice and reduces wealth inequality within the Muslim community.

Zakah funds are utilized to support a wide range of social welfare programs that directly contribute to the financial well-being of the Muslim community. These programs include providing food and shelter for the poor, assisting orphans and widows, and funding education and healthcare initiatives. By ensuring that zakah is distributed widely, the nisabin zakka ta kudi helps to improve the lives of the most vulnerable members of society and fosters a sense of shared responsibility.

For example, in many Muslim-majority countries, zakah funds are used to establish microfinance institutions that provide small loans to entrepreneurs and small businesses. These loans help to create jobs and stimulate economic growth, ultimately contributing to the financial well-being of the entire community.

Understanding the connection between the nisabin zakka ta kudi and its economic impact is crucial for Muslims seeking to fulfill their religious obligations and contribute to the well-being of their community. By recognizing the positive impact of zakah on the financial well-being of the Muslim community, Muslims can be motivated to pay zakah promptly and willingly, knowing that their contributions are making a tangible difference in the lives of others.

Spiritual significance

Within the framework of "nisabin zakka ta kudi," the spiritual significance of zakah as a form of worship and purification holds a central position. Zakah is not merely a financial obligation but a deeply spiritual act that purifies one's wealth and fosters a connection with Allah (SWT). The nisabin zakka ta kudi, by setting a minimum threshold for zakah obligation, ensures that those who are financially able are given the opportunity to engage in this act of worship.

The Quran emphasizes the spiritual significance of zakah in numerous verses. For instance, in Surah At-Tawbah, verse 103, Allah (SWT) states: "Take from their wealth a charity by which you purify them and sanctify them." This verse clearly establishes zakah as a means of spiritual purification, reminding Muslims that their wealth should not be hoarded but rather shared with those in need.

By fulfilling the obligation of zakah, Muslims demonstrate their submission to Allah (SWT) and their willingness to share their blessings with others. Zakah purifies the heart from greed and selfishness, promoting a sense of compassion and empathy. It also serves as a constant reminder of the transient nature of wealth and the importance of using it for righteous purposes.

Understanding the spiritual significance of zakah is crucial for Muslims seeking to fulfill their religious obligations with sincerity and devotion. By recognizing zakah as a form of worship and purification, Muslims can approach this duty with a deeper sense of purpose and gratitude, knowing that they are not only helping others but also purifying their own souls.

Social justice

The connection between "Social justice: Helps to reduce wealth inequality" and "nisabin zakka ta kudi" lies in the fundamental principle of zakah as a means of redistributing wealth and promoting economic equity within the Muslim community. The nisabin zakka ta kudi, by setting a minimum threshold for zakah obligation, ensures that only those who can afford it are required to pay. This ensures that the burden of zakah is fairly distributed and that those who are struggling financially are not unduly burdened.

Zakah funds are specifically allocated to support the poor and needy, including providing food, shelter, and financial assistance. By directing these funds to those most in need, zakah helps to reduce wealth inequality and promotes a more just and equitable society. For example, in many Muslim-majority countries, zakah funds are used to establish social welfare programs that provide healthcare, education, and job training to the underprivileged.

Understanding the connection between the nisabin zakka ta kudi and its role in reducing wealth inequality is crucial for Muslims seeking to fulfill their religious obligations with a deep sense of social responsibility. By recognizing the importance of zakah as a means of promoting social justice, Muslims can be motivated to pay zakah promptly and willingly, knowing that their contributions are making a tangible difference in the lives of others.

Global reach

The connection between "Global reach: Applicable to Muslims worldwide" and "nisabin zakka ta kudi" lies in the universality of the obligation to pay zakah for all Muslims who meet the nisab threshold. The nisabin zakka ta kudi, as a minimum threshold of wealth, ensures that Muslims worldwide are subject to the same obligation, regardless of their location or financial circumstances.

- Facet 1: Universality of Zakah

The nisabin zakka ta kudi is rooted in the Quran and Sunnah, which are the primary sources of Islamic law and guidance. These sources clearly establish zakah as an obligatory act of worship for all Muslims who possess the nisab. This universality ensures that Muslims worldwide are united in fulfilling this religious duty, fostering a sense of global community and solidarity.

- Facet 2: Practical Implementation

The nisabin zakka ta kudi provides a practical framework for implementing zakah on a global scale. By setting a clear and uniform threshold, it simplifies the process of calculating and distributing zakah, ensuring that Muslims worldwide can fulfill their obligations in a consistent and equitable manner.

- Facet 3: Cultural Diversity

Despite its global reach, the nisabin zakka ta kudi is flexible enough to accommodate cultural diversity among Muslims worldwide. While the core principles of zakah remain the same, local customs and practices can influence how the nisab is calculated and distributed, ensuring that zakah is adapted to the specific needs and circumstances of different Muslim communities.

- Facet 4: Social Impact

The global reach of the nisabin zakka ta kudi has a profound social impact. By obligating Muslims worldwide to pay zakah, it generates a significant pool of funds that can be used to address poverty, inequality, and other social issues affecting Muslim communities around the world.

In conclusion, the nisabin zakka ta kudi plays a crucial role in ensuring the global reach of zakah, uniting Muslims worldwide in fulfilling their religious duty. Its universality, practical implementation, adaptability to cultural diversity, and social impact make it an essential component of the Islamic economic system, contributing to the well-being of Muslim communities across the globe.

Frequently Asked Questions about Nisabin Zakka Ta Kudi

The nisabin zakka ta kudi, which refers to the minimum amount of wealth required to pay zakah, is a crucial aspect of the Islamic financial system. Here are some frequently asked questions and their answers to provide a better understanding of this concept:

Question 1: What is the significance of the nisabin zakka ta kudi?

Answer: The nisabin zakka ta kudi serves as a threshold that determines whether an individual is obligated to pay zakah. It ensures that only those who possess a certain level of wealth are required to fulfill this religious duty, promoting fairness and equity within the Muslim community.

Question 2: How is the nisabin zakka ta kudi determined?

Answer: The nisabin zakka ta kudi is typically set at the value of 85 grams of gold or its equivalent in other forms of wealth. This value is based on historical precedent and is intended to ensure that zakah is paid by those who have the means to do so.

Question 3: What are the benefits of paying zakah?

Answer: Paying zakah carries both spiritual and social benefits. It is considered an act of worship that purifies one's wealth and fosters a sense of compassion and generosity. Additionally, zakah funds are used to support various social welfare programs, contributing to the well-being of the Muslim community.

Question 4: Is the nisabin zakka ta kudi the same for everyone?

Answer: While the general principle of the nisabin zakka ta kudi is consistent across different schools of thought in Islam, there may be slight variations in its application. These variations can arise due to differences in interpretation and local customs.

Question 5: What happens if an individual does not pay zakah when it is due?

Answer: Not fulfilling the obligation to pay zakah when it is due is considered a serious matter in Islam. It is believed to have both spiritual and financial consequences, and Muslims are encouraged to make every effort to fulfill this duty on time.

Question 6: How can I calculate the amount of zakah I owe?

Answer: Calculating the amount of zakah owed involves determining the total value of eligible assets that exceed the nisabin zakka ta kudi. Once the total value is known, the applicable zakah rate is applied to calculate the amount due. It is recommended to consult with a qualified Islamic scholar or financial advisor for guidance on calculating zakah.

In summary, the nisabin zakka ta kudi is a multifaceted concept that plays a vital role in the Islamic financial system. It ensures fairness in zakah obligations, promotes social welfare, and encourages spiritual growth. Understanding the significance and implications of the nisabin zakka ta kudi is essential for Muslims seeking to fulfill their religious duties and contribute to the well-being of their community.

Transition to the next article section:The nisabin zakka ta kudi is closely tied to other aspects of the Islamic financial system, such as the calculation of zakah and the distribution of zakah funds.

Tips for Understanding Nisabin Zakka Ta Kudi

Understanding the nisabin zakka ta kudi, the minimum amount of wealth required to pay zakah, is crucial for Muslims seeking to fulfill their religious obligations. Here are some tips to enhance your understanding:

Tip 1: Study the Quran and Sunnah

The Quran and Sunnah provide the foundation for understanding the nisabin zakka ta kudi and its significance in Islam. By studying these texts, you can gain a deeper comprehension of the religious basis and historical context of this concept.

Tip 2: Consult with Islamic Scholars

Seeking guidance from qualified Islamic scholars can provide valuable insights into the nisabin zakka ta kudi. They can clarify its application, address specific questions, and ensure that your understanding aligns with Islamic principles.

Tip 3: Utilize Online Resources

Numerous online resources, such as articles, videos, and webinars, offer comprehensive information about the nisabin zakka ta kudi. These resources can supplement your study and provide diverse perspectives on the topic.

Tip 4: Attend Community Events

Participating in community events organized by mosques or Islamic centers can provide opportunities to interact with others, share knowledge, and ask questions about the nisabin zakka ta kudi. These events foster a sense of community and collective learning.

Tip 5: Calculate Your Zakah Obligations

To fulfill your zakah obligations accurately, it is essential to calculate the amount of zakah you owe. This involves determining the total value of your eligible assets and applying the appropriate zakah rate. Consulting with an Islamic financial advisor can assist you in this process.

By following these tips, you can enhance your understanding of the nisabin zakka ta kudi, its significance in Islam, and its practical implications. This knowledge empowers you to fulfill your religious duties with confidence and contribute to the well-being of your community.

Conclusion:Understanding the nisabin zakka ta kudi is a journey that requires dedication and continuous learning. By embracing these tips, you can deepen your knowledge, strengthen your faith, and contribute to the betterment of society.

Conclusion

The nisabin zakka ta kudi, the minimum amount of wealth required to pay zakah, is a multifaceted concept that holds profound significance in the Islamic financial system. Its historical roots, spiritual implications, and global reach underscore its importance in promoting social justice, fostering economic growth, and purifying one's wealth.

Understanding the nisabin zakka ta kudi empowers Muslims to fulfill their religious obligations with sincerity and contribute to the well-being of their communities. By embracing its principles, Muslims can play an active role in creating a more equitable and compassionate society, where wealth is shared and blessings are multiplied.

Related Resources:

Detail Author:

- Name : Astrid Jacobi

- Username : modesta.pfeffer

- Email : smitham.freda@yahoo.com

- Birthdate : 2004-04-25

- Address : 3801 Hackett Centers South Kurtmouth, WI 50440-2488

- Phone : 601-976-5776

- Company : Beier, Torp and Grant

- Job : Customer Service Representative

- Bio : Ex sunt occaecati impedit et et. Excepturi perferendis omnis qui id autem sint. Vero culpa iure praesentium quam consectetur aut rerum.

Socials

tiktok:

- url : https://tiktok.com/@ana_xx

- username : ana_xx

- bio : Unde rerum nesciunt dicta aspernatur.

- followers : 4669

- following : 1869

facebook:

- url : https://facebook.com/ana6462

- username : ana6462

- bio : Dolores quia a quia tempora architecto. Voluptate qui aut ad.

- followers : 292

- following : 855

linkedin:

- url : https://linkedin.com/in/ana_ferry

- username : ana_ferry

- bio : Ipsam quidem aperiam incidunt quia.

- followers : 1761

- following : 2986

instagram:

- url : https://instagram.com/ana8519

- username : ana8519

- bio : Autem et aliquam voluptas commodi. Similique quia officiis ex temporibus qui.

- followers : 2741

- following : 2780

twitter:

- url : https://twitter.com/ana.ferry

- username : ana.ferry

- bio : Quo magnam voluptas quod voluptas libero labore. Est rerum earum assumenda. Necessitatibus aspernatur non fuga error dolore.

- followers : 2346

- following : 382